CCBC

Our flagship debt collection product, the Delta Credit Manager, has a twenty year pedigree and nowincorporates the abilty to submit County Court claims, judgments and warrants electronically to the

County Court Bulk Centre (CCBC).

Court closures

In line with Civil Justice strategy, 49 courts have been designated for phased closure.The Government wants you to interact with the Court Service using data links; existing paper submission of

claims (form N1) will become slower.

CCBC Incentives

Court fees are signifcantly cheaper - around £20 per claim/ £30 per warrant of execution.20 x claims and 10 x warrants equates to a Court fee saving of £700 per month, alone.

Our software rents for way under this figure and comes with other benefits:-

- Same day processing - (before 10am)

- Speed - with our brilliant and easy-to-use case management system, your collection process

is streamlined, freeing up significant man hours - Accounting integration - transfer receivables data using our CSV import facility

- Charges - interest, Court fees and Solicitors fixed costs are calculated automatically

- Late Payment Act - penalties range from £40 to £100 per invoice

- Fixed Solicitors costs - minimum of £50 per claim, £22 per judgment

- Case Management - share detailed case notes across your network

Civil Procedure Rules

Practice direction 7C - CCBC - Claim processing software

The County Court Bulk Centre (CCBC) and the Claim Production Centre (CPC) were set up under rule 7.10of the Civil Procedure rules to permit the production of claims, judgments, warrants of execution and

paid data by means of electronic data transmission.

The current initiative by the Court service is to require all medium to large corporates and businesses

who issue claims above a certain quantity to transmit their claim data for the collection of simple trade

debts via the CCBC in Northampton.

The acceptance of volume paperwork to issue claim forms (N1), default judgments (N225) and warrants of

execution (N323) will be phased out in favour of transmission of data files via the CCBC.

See parts 7 and 12 of the Civil Procedure Rules.

We supply debt collection software which can interface with your existing accounting software such as SAP,

Oracle, Navision, Dynamics or Sage.

The monthly rental cost of the software is more than offset by the saving in Court fees.

Debtor data can be uploaded and refreshed automatically.

Our low-cost solution streamlines the electronic interaction with the Court Service, links with your accounting

system and brings many benefits:-

- Speed

- Lower Court fees via CCBC (revised 4/4/2011)

- Recovery of late payment charges

- Reduction in bad debts

- Charge Solicitors' fees

- Chase letters

- Statutory Demands

- Notes and reporting

Membership of the CCBC is free.

We would be pleased to explain the file build and transmission processes to you.

Jurisdiction - England and Wales

Civil procedure rules govern the practice and procedure to be followed in the Civil courts.They consolidate the previous Supreme court rules and County court rules and aim to ensure that

the civil justice system is accessible, fair and efficient and the rules are both simple and

simply expressed. The civil procedure rules are made by the civil procedure rule committee.

Rules of membership

Rules of membership should be read in conjunction with Civil Procedure Rule 7.10 and theaccompanying Practice Direction (7C).

2.1 The purpose of the CCBC is to relieve County Courts of the routine, repetitive tasks associated

with the processing of large volumes of debt claims in the areas of:-

- pre-judgment work

- entry of judgment (including registration)

- post judgment work (issue of warrants of execution and transfers for enforcement)

- issue of claims on magnetic media via the Claim Production Centre (CPC) (see CPC Code of Practice)

- initial court contact for handling defences and part admissions

- entry of judgment by acceptance, default or determination

- registration of judgments

- issue and reissue of warrants of execution

- transfer up to The High Court for enforcement by writ of fi fa

- transfer of cases for any other form of enforcement other than a warrant of execution

3.1 Any claimant wishing to make use of the CCBC shall be an authorised user of the CPC under

CPR Rule 7.10.

3.2 Each claimant shall agree to issue all CPC debt claims in the name of the

Northampton County Court (County Court code number: 335).

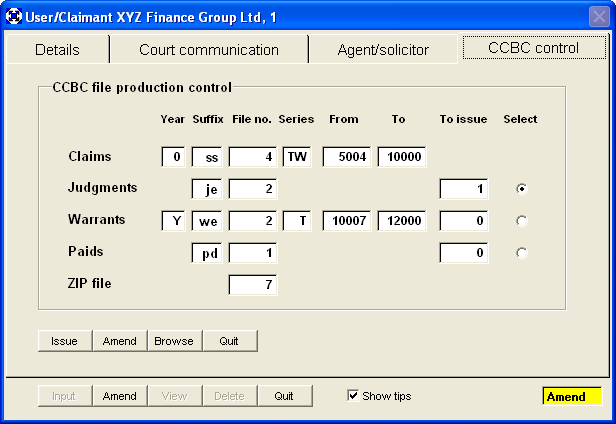

User/claimant data - CCBC control

The County Court Bulk Centre provides you with sequences of claim and warrant of execution numbers to use.The numbers are drawn off as you issue claims and warrants.

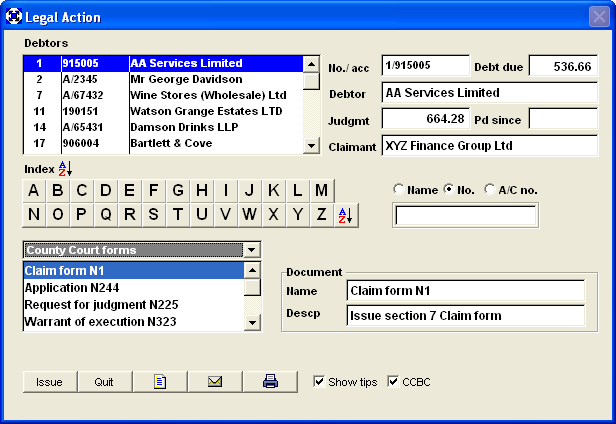

Legal action

Legal actions are controlled from a central Legal Action processing screen.

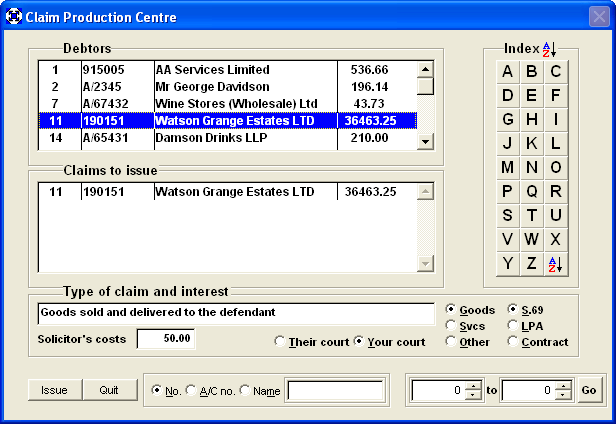

Claim production

Claims are issued on a simple 'point-and-shoot' basis. The type of pleading and type of interest is selected, alongwith solicitor's fees (if applicable). The data accumulates until you are ready to produce the day's claim issue

file, ready for easy transmission to the CCBC. They produce all the N1 and N9 paperwork which is served on the

defendant. You receive acknowledgement from the CCBC.